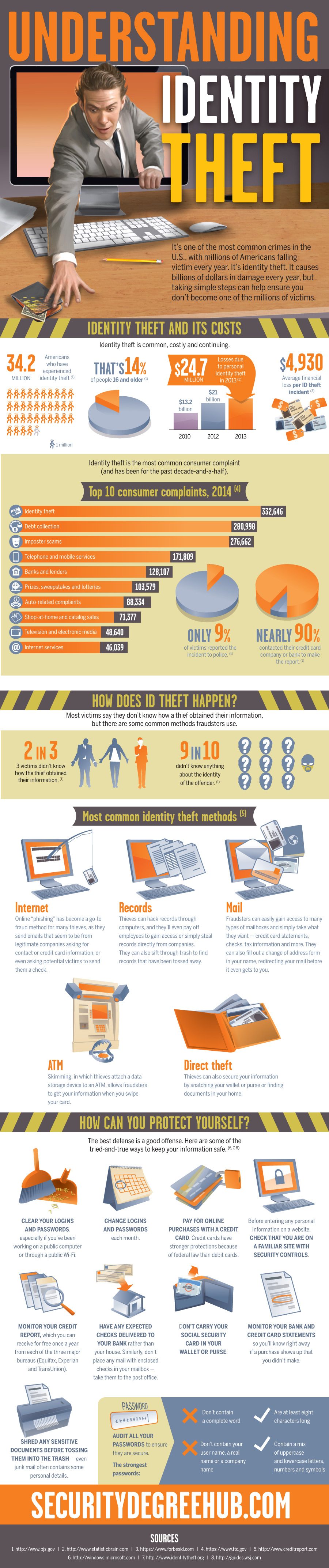

The understanding identity theft infographic explains this common crime that millions of Americans fall victim to every year.

Understanding Identity Theft

It’s one of the most common crimes in the U.S., with millions of Americans falling victim every year. It’s identity theft. It causes billions of dollars in damage every year, but taking simple steps can help ensure you don’t become one of the millions of victims.

Identity Theft and Its Costs

Identity theft is common, costly, and continuing.

34.2 million – Americans have experienced identity theft. That’s 14% of people 16 and older.

$24.7 billion – Losses due to personal identity theft

Total financial losses attributed to ID theft, by year

- 2010: $13.2 billion

- 2012: $21 billion

- 2013: $24.7 billion

- $4,930 – Average financial loss per ID theft incident.

Top 10 consumer complaints

Identity theft is the most common consumer complaint (and has been for the past decade-and-a-half). Only 9% of victims reported the incident to the police. Furthermore, nearly 90% contacted their credit card company or bank to make the report.

- Identity theft: 332,646

- Debt collection: 280,998

- Imposter scams: 276,662

- Telephone and mobile services: 171,809

- Banks and lenders: 128,107

- Prizes, sweepstakes and lotteries: 103,579

- Auto-related complaints: 88,334

- Shop-at-home and catalog sales: 71,377

- Television and electronic media: 48,640

- Internet services: 46,039

How Does ID Theft Happen?

Most victims say they don’t know how a thief obtained their information, but there are some common methods fraudsters use.

- 2 in 3 victims didn’t know how the thief obtained their information.

- 9 in 10 didn’t know anything about the identity of the offender.

Most common identity theft methods

Internet

Online “phishing” has become a go-to fraud method for many thieves, as they send emails that seem to be from legitimate companies asking for contact or credit card information or even asking potential victims to send them a check.

Records

Thieves can hack records through computers, and they’ll even pay off employees to gain access or simply steal records directly from companies. They can also sift through trash to find records that have been tossed away.

Fraudsters can easily gain access to many types of mailboxes and simply take what they want — credit card statements, checks, tax information and more. They can also fill out a change of address form in your name, redirecting your mail before it even gets to you.

ATM

Skimming, in which thieves attach a data storage device to an ATM, allows fraudsters to get your information when you swipe your card.

Direct theft

Thieves can also secure your information by snatching your wallet or purse or finding documents in your home.

How Can You Protect Yourself?

The best defense is a good offense. Here are some of the tried-and-true ways to keep your information safe.

- Clear your logins and passwords, especially if you’ve been working on a public computer or through public Wi-Fi.

- Change logins and passwords each month.

- Pay for online purchases with a credit card. Credit cards have stronger protections because of federal law than debit cards.

- Before entering any personal information on a website, check that you are on a familiar site with security controls.

- Monitor your credit report, which you can receive for free once a year from each of the three major bureaus (Equifax, Experian, and TransUnion).

- Shred any sensitive documents before tossing them into the trash — even junk mail often contains some personal details.

- Don’t carry your Social Security card in your wallet or purse.

- Monitor your bank and credit card statements so you’ll know right away if a purchase shows up that you didn’t make.

- Have any expected checks delivered to your bank rather than your house. Similarly, don’t place any mail with enclosed checks in your mailbox — take them to the post office.

Passwords

Audit all your passwords to ensure they are secure. The strongest passwords:

- Are at least eight characters long

- Don’t contain your user name, a real name or a company name

- Don’t contain a complete word

- Contain a mix of uppercase and lowercase letters, numbers, and symbols

Related:

- Top 10 Highest-Paying Security Careers

- 10 Cities for Security Jobs

- Top 10 States for Security Careers